THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

Table of Contents

Mutual Funds Advantages

Low Cost of Entry

As I mentioned above, the biggest benefit to mutual funds is the low cost of entry. You can easily get started with a few hundred dollars. From there, you can invest with as little as $50 if you set up an automatic investing plan (check out my guide to see why you need to do this).

Instant Diversification

When you buy a share of a mutual fund, you own a handful of companies at once. This is because a mutual fund is made up of many underlying companies. While you won’t own a large amount of one single company, the fact that you get to own many companies with a small amount of money helps to lower your risk while not impacting your returns.

Professional Management

I have no interest to spend my free time researching stocks to buy and then monitoring them on an ongoing basis to make sure they haven’t changed their strategy or the like. A mutual fund does all of this work for me. I can simply research a fund, buy it, and let the manager keep an eye on the fund. I win with more free time and being confident that my investment is being looked after.

Regulation

The government regulates mutual funds in many ways, including taxation and diversification. If a mutual fund isn’t meeting the guidelines, the fund gets in trouble and in some cases fined. This should give investors comfort, knowing that they won’t be swindled out of their money.

Ease of Investment

There are thousands of mutual funds out there to invest in, so it is easy to fund a few funds that are similar. This is great news for the investor because you can pick the fund that fits your needs best. You don’t have to settle for something subpar.

Buy Out of Reach Stocks

There are some stocks whose price makes it unavailable for the average investor to invest. When a share of stock is over $400, you need $40,000 just to own 100 shares! By buying into a mutual fund, you can own that company without having to put up as much money. Sure you won’t own 100 shares if you have $1,000 invested in the mutual fund, but you will have some shares of that company, plus many others too.

Disadvantages of Mutual Funds

Fees

Far and away the biggest disadvantage to mutual funds is the fee. All mutual funds charge a fee that varies from 0.08% up to over 3%. Just because you aren’t billed for the fund doesn’t mean you don’t pay. The fee comes off the top. For example, when a fund that charges you 1% shows an annual return of 7%, the fund actually earned closer to 8%. While this might not sound like a big deal, it is costing you thousands of dollars a year. Pay attention to fees.

Over-Diversification

Many investors overlook the fact that they own hundreds of companies within a single mutual fund. They see one investment and think they need more to be diversified, so they buy another mutual fund. The problem is that most mutual funds own the same underlying companies, just in a different percentage.

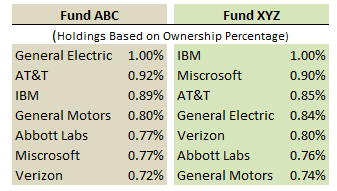

For example, Fund ABC and XYZ might own the following stocks:

Notice anything? The investments are the same, just a different ownership stake. When you buy many mutual funds in the same category, you run the risk of becoming over-diversified. You don’t need 40 mutual funds. In fact, you could get away with just 3. When it comes to investing, the saying “keep is simple stupid” applies.

Less Predictable Income

When you own various shares and fractional shares of the underlying stocks within a mutual fund, it makes it hard to estimate the income you will earn from the investment. Because of this lack of transparency, some investors, especially those looking for income will have a harder time knowing exactly how much income a particular mutual fund will earn. However for most investors, this isn’t a big issue.

Lack of Tax Control

With the buying and selling of the underlying stocks on a daily basis, a mutual fund runs the risk of incurring capital gains. This is because a mutual fund passes all gains through to the shareholder. This means that even if you didn’t sell any shares this year, you could earn capital gains and have to pay taxes on that money. Luckily, there are a few things in your favor.

First, the government taxes capital gains at a lower tax rate than ordinary income. Second, the mutual funds make an effort to limit capital gains as much as possible. But even still, you run the risk of incurring capital gains.

Final Thots

So with all of the information provided, where do you stand? I hope that you still will consider investing in mutual funds as the advantages far outweigh the disadvantages. This is because you can control the biggest disadvantage – fees – just by taking a few minutes and doing some research. You can even control becoming over-diversified.

At the end of the day, mutual fund investing makes sense for most investors. Don’t sit passively on the sidelines waiting to invest. Start investing today. Pick one or two low fee mutual funds and invest in them on a regular basis. Doing so will help you to realize your financial goals over the long-term.

Mutual fund fees are a killer! And the worst is that some of those fees aren’t even readily apparent when you’re choosing your investment. The company I work for, FeeX, is an online tool that shows you the fees that are easy to miss when you pick your funds.

And that’s a great tip on over-diversification as well — if you don’t pay enough attention to what’s really going on with your mutual funds, you end up with redundant, fee-overloaded investments.

Thanks for the post!

I know with some mutual funds and the different classes of funds, finding the fee you are paying is downright difficult! That tool sounds like a great thing. I’ll have to check it out!

Mutual funds can be so difficult to understand and like the previous comment if you don’t take notice of the fees you could be losing out on potential income. Thanks for such a useful article that will help clarify mutual funds for those who have yet to test the water by investing in a great option.

Thanks Sharon! I’m just trying to help people keep as much of their money as possible!