THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

You are here because you know if you want to get ahead financially, you need to budget.

But you keep putting a budgeting plan off because it just isn’t exciting.

I get it.

Budgeting is not fun and it is not exciting.

But if you find the right budget for you, it is something that you will stick to and you will even enjoy it.

Granted it still won’t be fun, but you won’t dread doing it.

And by following a budget, you will take control of your finances and start to change things.

You will go from being in debt to being out of debt.

You will go from saving nothing every month, to saving money every month.

And all of this change will open up new doors for you, including allowing you to reach many of your financial dreams.

So what is the right budgeting method for you?

After looking at the many budget variations out there, I feel confident in saying that the 50/30/20 budget is the best budget for most people.

Why is this?

It is simple to set up and to follow.

It takes a lot of the guess work out of creating a budget and is something you can set up and start following in the least amount of time.

So to help you get started with the 50/30/20 rule, I wrote this detailed guide.

Here you will learn what this budget rule is all about and how to set it up to make it work best for you.

I’ll even point out a few of the most common stumbling blocks too.

By knowing these upfront, you can be proactive with them and hopefully avoid them completely.

I’ll also introduce you to a few other budgets too.

The reason for this is simple.

While I am confident most of you will succeed best with the 50/30/20 budgeting rule, not everyone will.

So I am going to show you a few other options that might be a better fit.

With that said, let’s dive into the 50/30/20 budget!

Table of Contents

Your Complete Guide To The 50/30/20 Budget

What Is The 50/30/20 Rule?

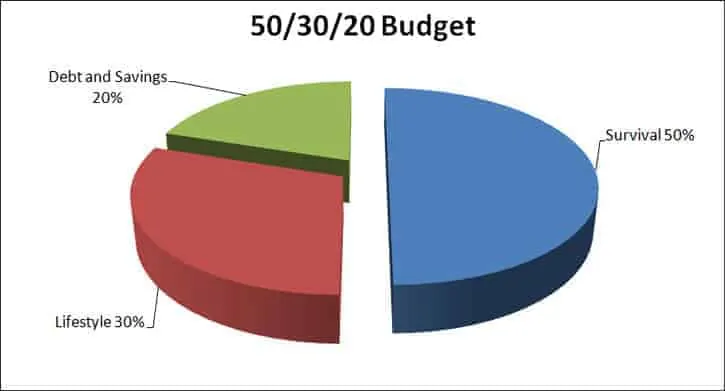

The 50/30/20 budget plan is easy to follow since you break all of your saving and spending down into 3 buckets.

After you do this, all that is left to do is to make sure the total of your spending in each bucket does not exceed the set limits.

Let’s take quick look at an example.

Here are the 3 buckets that make up the budget.

You create a needs category, a wants category, and a savings and debt category.

You now group all of your spending into these 3 buckets, total them, and divide each one by your monthly net income to see where you stand.

The key here is to use your take home pay and not your gross income.

If you use your gross income, your numbers are going to be way off.

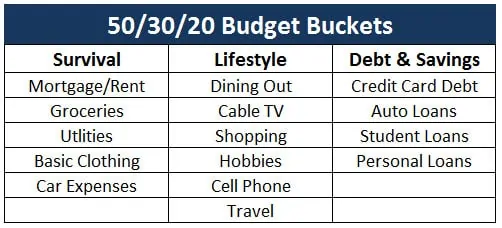

Here is a quick chart showing you what spending makes up each bucket in the budget.

For example, let’s say after organizing your spending for the month you come up with the following numbers:

- Survival expenses: $1,100

- Living expenses: $900

- Debt and savings: $400

- Total income: $2,400

The goal for the survival bucket in this example should be $1,200.

Since ours comes in at $1,100 we are good here.

The goal for the lifestyle bucket in this example should be $720.

Since ours comes to $900, we have some work to do.

The goal for the debt and savings bucket in this example should be $480.

Since ours comes to $400, we again have some work to do.

Now that you have a general idea of how the 50/30/20 budget is set up and works, let’s take a closer look at each bucket.

We want to make sure you fully understand it and make sure you are putting the right expenses into each.

The 50% Bucket: Survival

On the surface it is easy to understand this bucket.

It is for essential expenses you need to survive.

Think food, electric, water, rent or mortgage payment, etc.

Some people choose to put minimum debt payments here too.

This would be a car payment for example and credit card debt.

The thinking for credit cards is you need to make the minimum to avoid destroying your credit.

But you can easily become lazy here and add in expenses that aren’t needed for survival.

For example, you do need clothes to survive, but you don’t need a new outfit every week.

If you get lazy with your spending, you can easily put items in the survival bucket that don’t belong.

Likewise, even though it is important to have electricity, you should be taking steps to ensure that you are paying the least amount for it every month.

The reason for this is simple.

The more you control the survival and lifestyle buckets of your budget, the more money you will have for the debt and savings bucket.

I’ll show you why this is important as we continue.

The 30% Bucket: Lifestyle

This bucket is for discretionary spending and it is where most people overspend.

This is because all of your other monthly expenses go here.

Your cable bill goes here, hobbies, gym memberships, personal care spending, cell phone, membership or periodical subscriptions, and more all makes up this bucket.

Since most of us like to spend a lot of money, this is the bucket where we tend to get into the most trouble.

The good news is there are things you can do to control your spending here, which I’ll get into shortly.

The 20% Bucket: Debt And Savings

This final bucket is for debt repayment and savings.

If you choose to put your minimum debt payments in the survival category, then any extra you pay on debt goes here.

If you choose to not put your credit card debt into the survival category, then all of it would be accounted for here.

Whatever is left over goes into savings.

This is critical because without a savings category, most people would not save.

The fact is most people barely save 5% of their income, let alone 20%.

To make savings a priority is to create savings goals.

These goals will motivate you to make a point to save money every month.

How To Get Your Budget Aligned

Chances are when you set up the 50/30/20 rule for the first time your numbers aren’t going to be anywhere near the recommended percentages.

As I pointed out, most likely you will be over in either the lifestyle bucket or if you have debt, you will be overspending in the debt and savings bucket.

So how do you get your budget to align correctly?

There are a couple of options to work with.

- Slash your spending

- Pay off your debt

Let’s look at each of these more closely.

Slash Your Spending

As I mentioned before, this is the bucket where most of you will be out of whack.

To get things back in line, you need to take a little time and run through your expenses to see what is causing you issues.

If you are lucky, you might know what the issue is.

But if not, a quick review of your spending should show you where your issues are.

I would start off by focusing on your auto insurance, cable television, cell phone, and groceries as these tend to be your bigger expenses.

If you can knock these down you should quickly see an improvement.

- Related: Learn 9 hacks to slash your cable bill fast

- Related: See how to pay the least money for the best auto insurance

- Related: Find out the ways to lower your grocery bill the most

This isn’t to say you should ignore the smaller items.

You should still look over these too to ensure you aren’t wasting money anywhere.

If you find that you don’t have a lot of time to do this exercise, you can employ the help of Trim.

This is a service that will review your spending and let you know about memberships and subscriptions that you may be able to cancel.

It will also look at your cable bill and try to negotiate it to save you money.

In fact, people who use Trim to negotiate their cable bill save on average of $30 a month!

You can try Trim out by clicking the link below.

Pay Off Your Debt

If your budget is off due to too much debt, you need to start working on paying this debt off.

My favorite plan for paying off debt is to use the snowball method.

Here you organize your debts and pay them off from smallest balance to largest.

Doing it this way helps to keep you motivated throughout the process.

As you pay down your debt, you should begin to see your budget buckets get into better alignment.

And eventually, you will see this bucket coming in at less than 20% of your income.

When this happens, it is time to start increasing your savings rate.

How should you be saving your money?

Here is the order of preference when it comes to savings:

#1. Emergency fund: get your rainy day fund to $1,000

#2. 401k plan: invest up to your employer match or 5% if you don’t get a match

#3. Emergency fund: build this up to 6 months of expenses

#4. 401k plan: increase your contributions to 15% of your income

#5. Roth IRA: if your income is low enough, fund a Roth IRA

#6. Taxable account: invest in low cost ETFs and mutual funds

You should start out by putting all your money into an emergency fund until it reaches $1,000.

This will cover you for basic unexpected expenses for now.

Once you hit this goal, then you can begin investing in your 401k plan at work.

You want to invest up to your employer match at this point.

If your employer doesn’t offer you a match, then invest 5% into your 401k plan.

If you are lucky enough to have money left over in your bucket after investing in your 401k plan, take the remaining money and put this into your emergency fund.

You want to get your emergency fund up to 6 months worth of expenses.

Once you hit this goal, you stop adding money and shift your focus back to your 401k plan.

Your next step is to increase your contributions to 15% of your income.

Since this bucket calls for 20% of your income, the remaining 5% can be invested in a Roth IRA.

For this 5%, I recommend you invest it with Betterment.

They make getting started investing easy and take care of most of the work for you.

You can learn more about Betterment by clicking the link below.

As you grow your wealth and keep an eye on your disposable income, try to push the 20% savings up a little more.

Any extra you can save should go into a taxable investment account.

You can use Betterment for this account as well.

At the end of the day, if you can get this bucket to encompass 20% worth of savings, you are going to be amazed at how quickly you begin to grow your wealth.

Advantage Of The 50/30/20 Rule

The main advantage of the 50/30/20 budget plan is it is a great way to easily budget to get your spending in check.

And this will help you reach your financial goals without being too detailed with your spending.

What I mean by this is you are free to spend as much as you want in any spending category, as long as your total spending for the budget pie doesn’t exceed the set amount.

Most other budgets force you to track your monthly mortgage payment, your electric bill, your cable bill, etc. in specific categories.

This can be very time consuming and overwhelming and why most people dislike budgeting.

By just saying you can spend no more than 30% of your income on lifestyle spending, you have the freedom to spend as you please.

This is why the 50/30/20 budget plan works so well for so many people.

Drawbacks To The 50/30/20 Rule

Of course, like I said at the beginning of this post, just because the 50/30/20 budget plan is simple to set up and follow, it doesn’t make it perfect.

There are some drawbacks to this plan.

The two biggest issues with this budget are lack of specificity and it’s not ideal for high income earners.

Here is each of these issues in more detail.

Lack Of Specificity

As great as this budget is for flexibility and freedom in your spending, the lack of detail can end up masking some spending problems.

For example, if you are making $3,000 and have $900 a month to spend on lifestyle items, you could easily be wasting money here and not even realize it.

While you might be happy that every month you are staying true to your 30% bucket, you don’t realize you are wasting $400 a month eating out.

In other words, you don’t get specifics on your spending habits.

If you were using a more detailed budget, you would see this and could make changes to save more money every month.

And by saving more money each month, you could reach your long term goals end up retiring much sooner than you ever thought possible.

Or if early retirement isn’t an interest to you, saving more money each month will give you the opportunity to do things in your life that didn’t think were possible.

High Income Earners

The other drawback of the 50/30/20 budget is for high income earners.

For example, if you are making $200,000 a year, you would be budgeting $5,000 for lifestyle spending.

Add in the $8,333 for survival and you are spending over $13,000 a month!

That is a lot of money.

Because of this, this budget isn’t ideal for high income earners in its current form.

Alternatives To The 50/30/20 Budget

As great as the 50/30/20 rule is, it is not for everyone.

If you are in the small minority that thinks you would be better served with another type of budget, I have you covered.

Here are 3 additional options to help you get started budgeting and to take control of your finances.

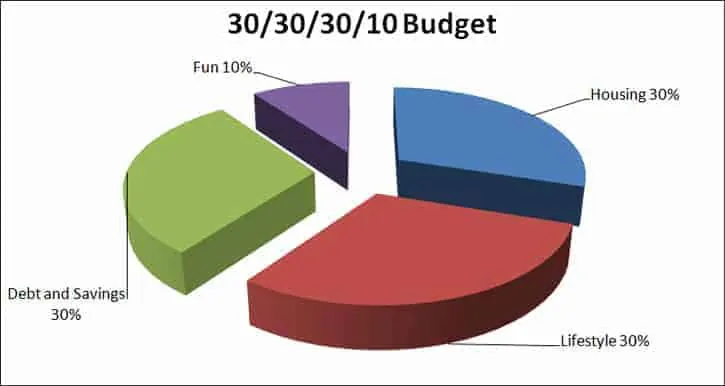

The 30/30/30/1030/10 Budget

The 30/30/30/10 budget is very similar to the 50/30/20 budget.

The main difference is that this budget gets more specific.

By being more specific, you limit some of the wasted spending you may otherwise be doing.

Also, you have the option to save more, which is great for those out there who want to retire early or for those paying off large amounts of debt.

Here is how the 30/30/30/10 budget breaks down.

As with the 50/30/20 budget, since you aren’t specifically tracking each spending category, you run the risk of overspending your money especially if you are a high income earner.

But with that said, the risk is a little lower because of the slight changes in bucket percentages.

Zero Based Budgeting

Zero based budgeting works by giving every dollar a job.

In other words, every dollar you earn in a given month is matched up with an expense.

To make it work, you write down your monthly income, then you list all of your expense categories.

Next, you write down your spending for each category.

In the end, you subtract your expenses from your income and the result should equal zero.

In most cases, your result will not equal zero.

You will be spending more than you are making.

So you need to adjust your spending so that you get your budget to equal zero.

After the month ends, you repeat this process all over again.

With the zero based budgeting system, you actively create a new budget every month since your income and expenses fluctuate each month.

This is true even if you have a steady paycheck.

While your income is set, your expenses will vary month to month.

Following a zero based budgeting system is more work and you are more detailed in your budget.

This helps you to narrow in on your spending and ensuring you are spending money on the things that matter most to you.

The biggest downside of this budget versus the 50/30/20 budget is that it doesn’t specifically require any savings.

So if you find your expenses are more than your income, you are most likely going to make just enough of an adjustment so that your budget works.

You aren’t going to actively make it a point to reduce your spending to the point where you can save money every month.

Tiller Budgeting

A Tiller budget solves the main issue with the 50/30/20 budget plan and the 30/30/30/10 budget because you are tracking each spending category.

While this sounds time consuming, Tiller helps you out by automating the hardest part of budgeting.

They automatically import your spending.

By having all of your transactions automatically added to your budget, all you have to do is take 5 minutes a day to update the transactions into preset spending categories.

Then the Tiller budget will update your budget and you will see where you stand in real time.

And my favorite part of the Tiller budget is that you can completely customize it to your liking.

You can click the link below to try out Tiller for free for 30 days.

The 50/30/20 Budget For Student Loans

If you have a lot of student loans, you aren’t alone.

Having this debt is a drain on your finances and your emotions, so it makes sense to try to pay off this debt as quickly as possible.

With the 50/30/20 budget, paying off your student loans can be tough to do, simply because your monthly debt payments might total more than the debt and savings bucket allow.

But I have a solution for you.

You can still use this budget for student loans. You just flip two of the buckets around.

Instead of 30% of your income going towards lifestyle and 20% towards debt and savings, you now have 30% going towards debt and savings and 20% for lifestyle.

Here is why this works.

Coming out of college, you are used to living on very little money.

If you can keep living this way for a couple years after you graduate and put more money towards your student loan debt, you will open the door for more options in life.

For example, if you can pay down your student loan debt or even pay it off, you suddenly have a few hundred extra dollars each month.

You can start saving for a house. You can put that money towards retirement.

Or if you find out your dream job is your nightmare job, you can quit and find a better fit even if it has a lower salary.

If you didn’t follow this budget for student loans, you would be paying back this debt well into your 30s and in some cases, your 40s.

Now you are stuck not being able to save for a house or retirement.

And worse yet, you are stuck in your nightmare job.

Frequently Asked Questions

I get a handful of questions from readers about this budget.

Most revolve around debt and savings, as this category is the most confusing.

Here are the answers to the questions you most likely have.

How do I treat mortgage payments?

Mortgage and rent payments are part of the survival category.

This can be confusing since a mortgage is debt.

But since it tends to be your largest payment, it fits into the survival category.

The catch here though is if you plan on making additional payments.

If you pay extra, the extra payments should be part of your debt and savings category.

What category do credit card payments go into?

Credit card debt payments fit into the debt and savings category.

Note this is only for debt.

If you use your credit cards for monthly spending, you need to keep note of what spending was for essential expenses and what was for lifestyle spending.

How are retirement contributions that are pre-taxed accounted for?

You can handle pre-tax retirement contributions one of two ways.

First, you could do the math to determine the percent of your income you are saving and then adjust the category percentages accordingly.

For example, say your net income is $1,000 and you put $100 into your 401k plan.

In this case, $100 is 10% of your $1,000 net, so you can change your debt and savings category to 10% and increase your other categories.

Or you could leave it at 20% is you are trying to pay down debt.

The other option is to completely ignore pre-tax savings and just following the categories as is.

The issue here is if you max out your 401k plan, you might feel that saving another 20% of your income is too much.

In this case, you need to make adjustments to have the budget fit your goals.

What category do car payments go into?

Car payments can also be handled in different ways.

The first is to have the payment be part of the 50% bucket since a car is a necessity for most people.

Others however choose to put a car payment into the debt and savings category.

Again, this is the beauty of this budgeting rule.

Individual situations are different and you can tailor it to fit your needs.

Wrapping Up

If you want to take control of your finances, improve your financial health, and have more opportunities in life, you have to start following a budget.

And the easiest budget to start with is the 50/30/20 budget.

I know that the idea of a budget doesn’t sound exciting, but when you think about how much better your life will be when you follow one, you will get excited.

You will know you are making smarter financial decisions and are growing your wealth.

Don’t make the mistake so many others do.

They think that if they follow a budget they have to sacrifice all fun today in hopes of having fun at some point in the future.

A smartly constructed budget allows you to enjoy life today and tomorrow.

And using the 50/30/20 budget plan is a great first step in this direction.