THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

You always need more cash but somehow figure out ways to get by.

It’s true that getting by financially in college can be tough.

You are focusing the majority of your time on your studies and enjoying life, which means personal finance quickly takes a back seat during these years.

Finding a fast online personal loan can be difficult especially if you have a low credit score.

This is a problem.

Many students get into credit debt and student loan debt, which effects their lives for many years to come.

Just as bad, by not learning about money habits now, you put yourself that much farther behind.

As a result, you make dumb money mistakes throughout your 20’s and in some cases even your 30’s.

What if you did things differently?

What if you learn some personal finance tips now?

The impact this would have on your future self would be life changing.

While all your friends would be struggling to get by, you would have a financial foundation already in place.

While it doesn’t seem that important now, your future self will thank you.

So what are the most important tips for how to manage money in college?

In this post I break them down for you.

By the end, you will have a plan for personal finance success in college and the years to come.

Looking back, I wish I had this financial advice when I was in college.

Table of Contents

17 Best Personal Finance Tips For College Students

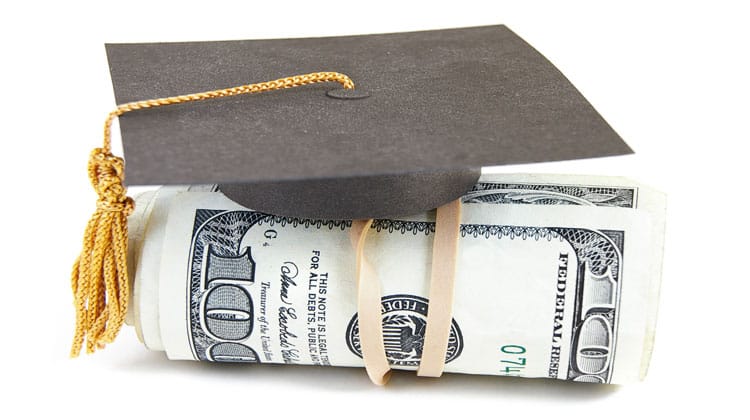

#1. Create A Budget

One of the best money management tips I can offer is to learn how to budget.

Learning to create and use a budget is a skill that will be immeasurable now, and for the rest of your life.

By creating a budget, you know where you are spending money so you can make sure you don’t waste money on stupid purchases.

Or it at least helps you to limit the damage.

Plus a budget will help you to save money for future expenses, like a spring break trip, vacations, buying a house, retirement, and more.

The bottom line is you need to wrap your head around budgeting.

The nice thing about budgeting is that it is always evolving. As your life changes, you need to edit and adjust your budget.

What this means is you aren’t stuck with a budget forever. You can modify as you go.

But where do you get started?

My favorite budgeting tool is Tiller Money.

They automate budgeting but still allow for you to get hands on and participate in your budget, which is huge.

While Tiller does cost a few bucks a month, it is free for college students for a year.

You can click on the link to try it out.

If you would rather go the completely free route, you can create a spreadsheet budget.

This option allows you to make you budget exactly how you want.

But this can be difficult for beginners.

Luckily you can use the simple 50/30/20 budget.

It’s a great way to get your feet wet and learn the basics of budgeting.

And while you could look to free online budgeting tools and apps, I recommend you look at each in detail.

Many are free because they collect your data and sell it to advertisers or show ads to you.

These could tempt you to make some bad financial decisions.

Budgeting Tips For College Students

- Don’t get caught up trying to make the perfect budget. You can modify it as you go.

- Be careful not to throw a lot of expenses into a miscellaneous category. You’ll never get a good idea of where that money went.

- Keep notes in your budget. A purchase at a fast food restaurant is obviously dining out. But a purchase from Amazon could be almost anything.

#2. Understand Wants vs. Needs

Knowing the difference between wants and needs is critical for financial success in life.

Sadly, most adults cannot differentiate between the two.

For example, if you don’t have a land line phone, then a cell phone is a need.

But having the latest cell phone when one is released is not a need. It is a want.

Take a few minutes to think about what you need to live and what you would like to have in life.

They are very different things.

Luckily in most cases, you can easily tell the difference if you think for a minute.

But others, like the cell phone example, are ones that can easily trip you up.

Another example would be clothing.

You need business casual clothes for work.

But if you have a closet full of clothes, you do not need more.

This isn’t to say you should not buy more clothes, but understand that you don’t need them in order to live.

#3. Practice Patience

Advertisers are great at getting us to think we have to buy something.

They make a product or service seem like it is the missing piece to a happy life.

The truth is, most times you don’t need this item.

The advertisement simply is taking advantage of our brains and tricking us into thinking we need the product.

Then in a few days, when we get past the hype and are able to think more clearly, we have buyers remorse.

The solution is to learn to practice patience.

Before buying anything, wait.

Think through the purchase first.

Do you really need it? How will it add value to your life?

You can even play games to help make thinking through purchases more enjoyable.

By having the skill to clearly think through purchases first, you will save a lot of money and have a lot less clutter.

#4. Understand Who You Are

You might have heard the term “keeping up with the Joneses”.

This is when you see what others have and want the same things, regardless of your financial situation.

The idea of keeping up with others has intensified over the years with social media.

We see others post about their amazon vacation or the great things happening in their life and want the same thing.

We feel a sense of being left out or behind.

This recently happened to me.

I was with family and everyone had an Apple Watch.

They were talking about it and I felt like I needed to have one too.

My younger self probably would have bought one too.

But I stopped and thought about it. I quickly realized I have zero need for it.

I saved myself a lot of headaches by researching it first.

Remember that you only see one side of people, the side they want you to see.

Behind closed doors their finances or their relationships could be falling apart.

The point is, be proud of who you are and don’t give in to the need to keep up or impress others.

At the end of the day, you are the only one that has to live with yourself.

Be true to yourself and you will be much happier and successful.

#5. Be Cautious With Student Loans

Student loans are a blessing and a curse.

They are great because they can help you cover the cost of college.

But if you aren’t smart about them, they can have a major impact on your finances and your life after college.

The best financial advice I can give you regarding student loans is to take out as little as possible.

It is tempting to take out as much as you are qualified for.

But many times this is more than the cost of your tuition.

And the excess goes towards living expenses.

I am a perfect example of this.

When I was in grad school, I qualified for an amount much higher than the cost of going.

I used the extra money to live off of since money was tight.

But the money went towards enjoying things I wanted and not what I needed.

After I finished my degree, I suddenly had a $300 monthly payment that made my monthly budget even tighter.

While it is tempting to take out as much as you can with student loans, it is important you avoid making this mistake.

Find other ways to lower the cost of college and live the college life.

Your future self will thank you.

#6. Lower The Cost Of Your College Education

It’s well known that college is expensive, and this is why so many people turn to student loans.

But I just told you to avoid them as much as possible.

So how do you go about lowering college costs?

There are a handful of things you can do.

Here is a short list.

Become A Resident Advisor

This is the perfect job for many. You work with other resident advisors in a dorm or apartment building to make sure things go well.

You respond to student issues and help make sure the rules are being followed.

Most colleges will pay you in the form of free or reduced cost of room and board, saving you a lot of money.

Scholarships

Even if you are already in college, there is no reason you cannot find and accept scholarships.

There are plenty out there, all you have to do is look around.

Most only require a short essay and you earn some money towards school that doesn’t have to be repaid.

Just trying for getting a couple can be one of the best financial decisions you ever make.

Here is a great starting point for finding scholarships.

Financial Aid

While not as lucrative as scholarships, you could qualify for financial aid from your school.

There are many factors that determine your award, but this shouldn’t stop you from applying every year.

After all, getting something is better than nothing.

Work Study

This is an option buy won’t be something that covers a lot of college costs.

Basically you work a set number of hours a week on campus and earn a paycheck.

You then use this money to cover expenses.

When I did this, I was working 10 hours a week in the library.

It wasn’t a lot of money, but it was something and when it was slow, I was able to get some school work done.

Outside Employment

Many more employers are offering education assistance to their workers.

For example, part time workers at McDonald’s can get up to $3,000 for college.

And as the student debt crisis increases, more and more are doing so.

You might even consider working a full time job and going to college part time.

While it will take you longer to complete your degree, it will cost you a lot less.

This is because your employer will help you.

At one company I worked for, they paid for 2 courses per semester.

I took 2 courses in both the fall and spring and one more in the summer, all for free.

The only catch with these programs is that most employers require you to stay with the company for a few years after you complete your degree.

#7. Begin To Build Credit

College is a great time to start building a solid credit history.

By getting a credit card in college, you can quickly establish healthy credit that will serve you well for the rest of your life.

How is this so?

By having great credit, you will qualify for lower interest rates.

This means a more affordable monthly house payment.

It could mean 0% interest in an auto loan.

It even means lower insurance rates in many states.

Here is how you can be smart with building your credit.

First, get one card.

Avoid the temptation to get multiple credit cards. You only need one.

Avoid thinking you need a card with a high spending limit having a lot of available credit can get you into trouble fast.

Use the link below to find a great student credit card or a secured credit card for people with no credit.

Then pick one expense a month to charge to your card. The key here is only one.

Finally, pay the bill in full and on time.

Rinse and repeat.

This is how I used my card in college.

I have a $500 limit and I put one week’s worth of groceries on it every month.

That was about $25.

Then I paid it off.

My credit score last I checked was 805.

Of course you have to be smart with your credit going forward to have a high score.

You just can’t be smart for a few years and then think all is good.

#8. Avoid Credit Card Debt

As smart as it is to build credit in college, you have to avoid credit card debt at all costs.

Don’t give in and start buying things, planning to pay it off later.

You are paying a high interest rate on your debt and that will destroy you financially.

It will also add stress to your life.

While I started out smart with credit, I did eventually fall into the debt trap.

It was not fun.

I was stressed all the time and miserable.

If you feel tempted or start spending more than once a month, cut your card up and throw it away.

Or give it to your parents to keep for you.

As with student loan debt, the more you can avoid credit card debt, the more your future self will thank you.

#9. Find Ways To Be Frugal

Being a student requires that you learn to be frugal.

You have very little money coming in, so you have to use some smart spending tricks to save money.

- Related: Click here for the best frugal living tips

- Related: Click here to learn how to eat out for cheap

- Related: Click here to learn how to save money on groceries

Use coupons and to save money.

Also, use your ID card for student discounts. Many businesses will offer a reduced price on goods and services for students.

Go in with your roommate to buy some items in bulk and split the cost.

Learning how to save money and being frugal is one of the most important money tips you can learn.

This is because you can use this skill for the rest of your life to keep costs low.

Tips For College Students To Save Money

- Use sites like Craigslist and Freecycle to get used items for free.

- Take care of the things you have so they last longer

- Shop at the dollar store for personal care items

- Take advantage of free and discounted entertainment your school offers

- Consider moving off campus if you can rent an apartment cheaply

- Instead of public transportation, see if a classmate with a car could drive you

#10. Learn To Think Outside The Box

Related to the above point about being frugal, learn to think outside the box.

How can you do things differently to start saving money?

If you are a guy and have a simple hair style, does someone on campus have clippers and cut hair?

You just saved money.

Maybe you can rent textbooks or buy them used online to save money.

Or, you could go dumpster diving to get things for free.

There are many ways you can lower the cost of things or even get free things.

You just have to learn how to think outside the box a little bit.

#11. Get A Side Hustle

Having extra money has many benefits.

It can make your monthly budget more manageable.

It can help you to save for big purchases, like a vacation or a house.

Or it can boost your retirement savings so you can retire one day, or even better, retire early.

So don’t overlook the power of finding ways to make extra money on the side.

- Related: How to make the most money as a waiter

- Related: Best ways to make money online

I started doing this in college.

I started out with a part time job on campus, then found some additional ways to bring in more income.

The money helped me to make college more enjoyable.

I was able to buy some more pizzas and beer. I was able to go to a couple baseball games and concerts.

And I kept up with a side hustle after college too.

Doing so allowed me to quit the rat race.

The money I was making from my side gig was put into savings.

Then one day when I was laid off, instead of stressing about money, I was calmer because I knew I have a large savings.

I then worked at turning my side hustle into a larger source of income.

The bottom line is, you never know what life will throw at you.

Having money saved is a great feeling.

As a matter of fact, I never heard of someone complaining they had too much money saved.

#12. Set Up A Savings Account

Having a savings account is a smart financial move.

The reason is because if you have all your money in your checking account, you will be tempted to spend it.

Trust me, I’ve done this and seen plenty of others do it as well.

By opening up a savings account, you put the money out of sight and let it grow.

Then you will have the money should an emergency happen and you need it.

If you are looking for a good online banking option to use, I recommend CIT Bank.

They offer a competitive interest rate and are super easy to use.

You can even have a separate bank account for each of your savings goals.

Just click on the link below to get started.

#13. Learn To Pay Yourself First

One of the most important money savings tips is to learn to pay yourself first.

This simply means when you get paid, you put some money into savings and live off the rest.

Sadly, most people do the opposite.

They spend first and try to save what is left over.

But since they get confused with wants vs. needs and aren’t patient, they spend everything they make and save nothing.

Not surprisingly, they never get ahead since they are not saving anything.

Make sure you save before you spend anything.

This is easily done by putting money into your 401k, assuming your work offers one.

You can also save first by setting up an automatic transfer.

Set it up on the days you are paid and you never have to think about it again!

#14. Learn About Investing

Investing your money is important if you want to get ahead.

No other investment offers you the return on your money like the stock market does.

But understand when I am talking about investing, I am talking about the long term.

I am not suggesting you trade stocks or buy or sell often.

I recommend you pick a few high quality investments and hold them for many years, adding money on a regular basis.

When you invest this way, you will grow your wealth nicely.

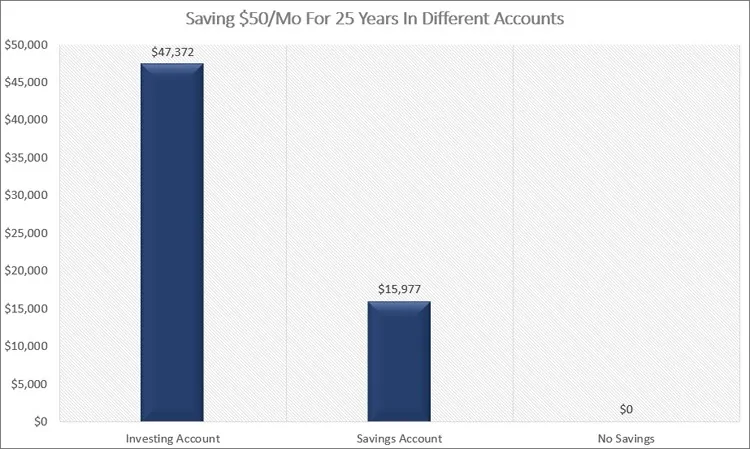

Here is an example for you.

Let’s say you invest $50 a month for the next 25 years and earn 8% annually.

You end up with $47,372.

If you had put your money into a savings account earning 0.50%, you would have $15,977 after 25 years.

And if you didn’t invest or save anything you would have nothing in 25 years.

When it comes to investing, the best way to get started is to use Acorns.

Use can invest as little as $5 a month and on top of this, you can simply invest your spare change.

This means when you buy something and use your debit card, Acorns will round up the purchase to the next dollar and invest the change.

You can choose to just invest your spare change if you want.

And don’t think your spare change won’t add up.

Many people invest a few hundred dollars a year in just their spare change.

To get started with Acorns and get $5 to open your account, click on the link below.

#15. Understand The Power Of Time

Related to investing is the concept of time.

The sooner you start investing, the more time your money can grow and compound.

Here is a perfect example to drive this point home.

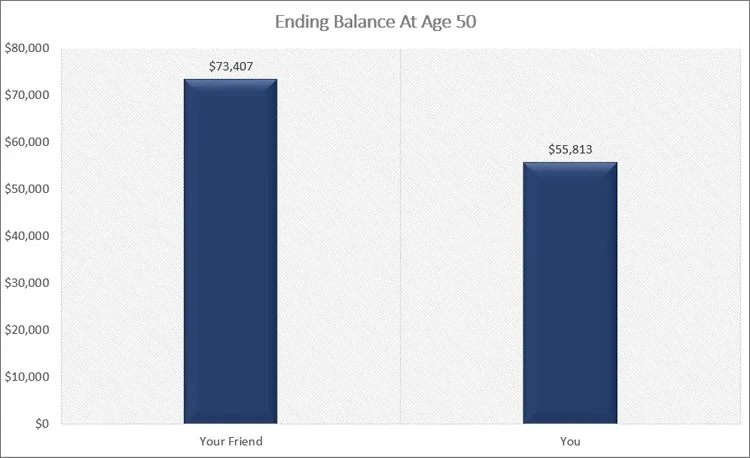

Your friend reads this article and takes it to heart.

They start investing $50 a month at age 20. They keep investing $50 a month every year.

They earn 8% a year on their money.

You ignore this advice and wait until you are 35 to start investing $50 a month and earn the same 8%.

Fast forward to when you are both 50 years old.

How much more money does your friend have?

He has $73,407 while you have $17,594.

Waiting 15 years cost you $55,813 in growth!

Even if you started at age 35 and invested $125 a month, you would still have $29,421 less than your friend.

Time is your best friend when it comes to investing.

Make it a point to start investing as early as you can.

And here is a bonus tip.

If you earn income, put the money you earn into a Roth IRA.

This will allow it to grow tax free until retirement.

And as an added bonus, you can take some of the money out to buy your first house!

#16. Learn To Think Long Term

A key difference between people that have a lot of money and those who don’t is how they look at things.

For example, a wealthy person will look at the long term, or the total cost of something.

A person without wealth will focus on the short term, or the monthly payment of something.

It is critical you look long term as much as possible.

If you are buying a car for example, avoid focusing at what the monthly payment is.

Look at how much the car will cost you, including the interest you will pay from the loan.

Or don’t focus on the cost of a high quality item that costs more, rather realize how much longer it will last and as a result, save you money.

I’ve bought cheap t-shirts that last barely a year because I focused on the price tag.

But in 5 years, I spent more money replacing these shirts every year than I would have if I just bought the more expensive shirt.

Of course, this isn’t always the case and you shouldn’t buy costlier item thinking it’s the smartest decision.

There are times when buying the cheaper version makes perfect sense.

It all ties into thinking through your purchases and being smart with your money.

Finally, when making major purchases, spend some time doing research online.

Read reviews other users have left as well as comparisons between different makes and models.

This will help you to make smarter decisions and ultimately save you money.

#17. Set Goals

Setting goals is an important part of life.

Having goals will motivate you to grow as a person and achieve more.

Just understand that life happens.

What I mean by this is you might think you want 3 vacation houses and a yacht today, but in 10 years realize these things are not of interest or importance to you.

This isn’t to discourage you from setting goals.

It’s just to understand that as life happens, your goals will change too.

Not all the goals you set will change, but a handful will.

So set goals for yourself and when you review them, by open to editing them, removing them, and adding new ones.

Finally, make sure your goals include other life goals as well.

I don’t want you to sell yourself short by only making a financial goal.

#18. Build Relationships

What does building relationships have to do with financial tips?

A lot.

Once you get out of college, you will find that while it is important what you know, it is just as important who you know.

And by building up a network of people, you will have more opportunities in life.

For example, my wife decided to start a life coaching business.

She could have placed ads hoping to find clients.

But instead she reached out her network.

There was zero cost and she found 5 clients.

And even if that sounds like a low number, here is where it gets more interesting.

People knew she had a good work ethic and so when they came across people in their network looking for coaching, they referred them to my wife.

This is why building relationships is important.

You never know when you will need the help of someone, even some of your professors.

This is especially true if you are looking to go to graduate school.

Having recommendations from professors could be the difference between getting accepted and not.

So make sure you build a network.

It might not make sense now, but in the coming years, you will be grateful you have a large network.

#19. Have Fun

At the end of the day, personal finance and money should never feel like a chore.

It should be fun and interesting.

So don’t think you need to follow all these tips right now.

You can start off with a few and work the rest in slowly.

Just make sure you begin to follow them sooner rather than later.

The reason for this is simple.

You won’t be in as good of financial shape as you could be.

And when you are in good financial shape, you have more options and opportunities in life.

This is critical to understand.

When you have a good financial foundation, you can take a job you love that might pay less and not be stuck in a job you hate.

Or you can take advantage when real estate prices are low and buy an amazing house dirt cheap.

So work through them at your own pace, but don’t overlook any of them for too long.

Frequently Asked Questions

I get a lot of emails from students about money.

After a while, many of the emails began repeating, so I decided to create an FAQ section to save you time.

I still encourage you to email me with your questions if they are not answered below.

How can I be financially smart in college?

The best ways to be financially smart are as follows.

- Avoid credit card debt

- Avoid massive amounts of student loan debt

- Find a side hustle and put some money into savings

If you can do these 3 simple things, you will graduate college will a nice nest egg and won’t be buried in debt.

This will give you more options for how, when, and where you start the next chapter in your life.

How do you survive financially in college?

The best ways to survive financially as a college student is to simply accept that money is going to be tight and you need to be creative.

Think outside the box for ways to get things on sale or at a discount.

Additionally, think of some easy ways you can make a few dollars on the side to help cover your costs.

How can I save money on food in college?

There are a few easy ways to save money on food in college.

The easiest is to look at the meal plan.

Most colleges offer different meal plans and this could save you a lot money.

When I was on the meal plan, I made sure to eat as much as a I could so I would be less hungry for dinner, which I paid for on my own.

Another idea is to buy store brands as they are cheaper than name brand products.

From there, stick with foods that are cheap.

This includes pasta, eggs, and beans.

Try to limit sugary drinks and drink water instead.

Finally, make it a point to shop sales and even consider buying some foods in bulk and splitting with roommates or classmates to save money.

How to manage your finances as a student?

The best thing you can do is to create a budget.

By learning how to build and follow a budget, you will be able to understand needs vs. wants and where your money is going.

These lessons will prove valuable to you once you graduate college and start your career.

Should I invest when in college?

Yes.

Time is your best friend when it comes to investing.

The longer you can invest, the more your money compounds and grows into larger amounts.

So the sooner you start, the better.

Don’t make the mistake thinking that investing $5 isn’t worth it.

This will grow over the years and as you invest more, it will grow even more.

What is the best money saving plan for college students?

I recommend starting out with a savings account and building that first.

Once you have $500 in your emergency fund for unexpected expenses, I would open an investing account and start investing.

You could keep saving in your savings account and use Acorns to invest your spare change to make it easier.

Wrapping Up

There are 17 smart money management tips for college students.

But the truth is, these tips are great for anyone, regardless of age.

However if you are in college or are a young adult, you have the advantage here as you learn them a lot younger than others.

The sooner you can take these to heart and live by them, the sooner and better your finances will be.

Not just now, but in the future as well.